1031 Tax-Deferred Exchanges on the Gulf Coast: What Investors Need to Know

By Meredith Amon, Licensed in Alabama and Florida

Guided by Integrity. Backed by Experience. Search the Gulf with Meredith Folger Amon.

As a Gulf Coast real estate advisor, I often talk with investors who want to maximize their portfolios while minimizing taxes. One of the most powerful tools available is the 1031 tax-deferred exchange. Whether you’re considering investment properties in Gulf Breeze, Florida, or exploring opportunities in Orange Beach, Gulf Shores, Perdido Key, Pensacola, Destin, or along 30A and Santa Rosa Beach, a 1031 exchange can open doors for wealth building and long-term growth.

That said, it’s important to note that I am not a tax advisor. This article is meant to share insight and local perspective, but you should always consult with a qualified tax attorney or CPA before making any decisions.

What is a 1031 Exchange?

A 1031 exchange, named after Section 1031 of the IRS Code, allows you to defer paying capital gains taxes when you sell an investment property and reinvest the proceeds into another “like-kind” property. On the Gulf Coast, that might mean exchanging a rental condo in Orange Beach for a beach house in Santa Rosa Beach, or trading a multi-family property in Pensacola for a waterfront investment in Destin.

The beauty of this strategy is that it allows investors to keep more of their money working for them instead of sending it straight to the IRS.

Frequently Asked Questions About 1031 Exchanges

1. If I own investment properties in Alabama, can I purchase investment properties in Florida and avoid capital gains taxes?

Yes. A 1031 exchange is a federal tax code provision, so you can sell in Alabama and purchase in Florida (or vice versa). As long as both properties are investment or business properties, and you follow the exchange rules, you can defer capital gains taxes.

2. Do I have to pay taxes to Alabama if I move my investment dollars to Florida?

While the federal government allows the deferral, states handle things differently. Alabama has state income tax, so if you sell an Alabama property, Alabama may require taxes on that gain—even if you reinvest in Florida. Florida does not have a state income tax, but moving your residence to Florida does not automatically erase Alabama’s tax requirements on gains from Alabama property. Always verify with your tax attorney.

3. Would it be better to move my primary residence to Florida for two years and then sell my Alabama properties?

Some investors consider this because Florida has no state income tax. However, the IRS rules for primary residences are different than for 1031 exchanges. Living in a home as your primary residence for two of the past five years may allow you to exclude up to $250,000 ($500,000 for married couples) of gain from taxes. This strategy can work, but it depends on your circumstances. If your Alabama properties are true investments, a 1031 may be more beneficial than trying to convert them into primary residences.

4. How long do I have to identify new properties after selling?

Once you sell, you have 45 days to identify potential replacement properties in writing, and 180 days to close on one or more of them. These deadlines are strict, and missing them will disqualify your exchange.

5. Can I roll two properties into one property—or one property into two?

Yes. You can sell multiple properties and roll them into one larger replacement property, or you can sell one property and divide the funds among multiple replacements. For example, you could sell two condos in Perdido Key and purchase one large vacation rental in Santa Rosa Beach.

6. Does the value of the new property have to be equal or greater?

To fully defer taxes, the replacement property (or properties) must be of equal or greater value, and you must reinvest all of your net proceeds. If you “trade down” or take some cash out, that portion will likely be taxable.

7. Can I exchange into short-term rental properties along 30A or Destin?

Yes, as long as they are considered investment properties (held for rental or business purposes). Vacation rentals qualify, provided they are not strictly for personal use.

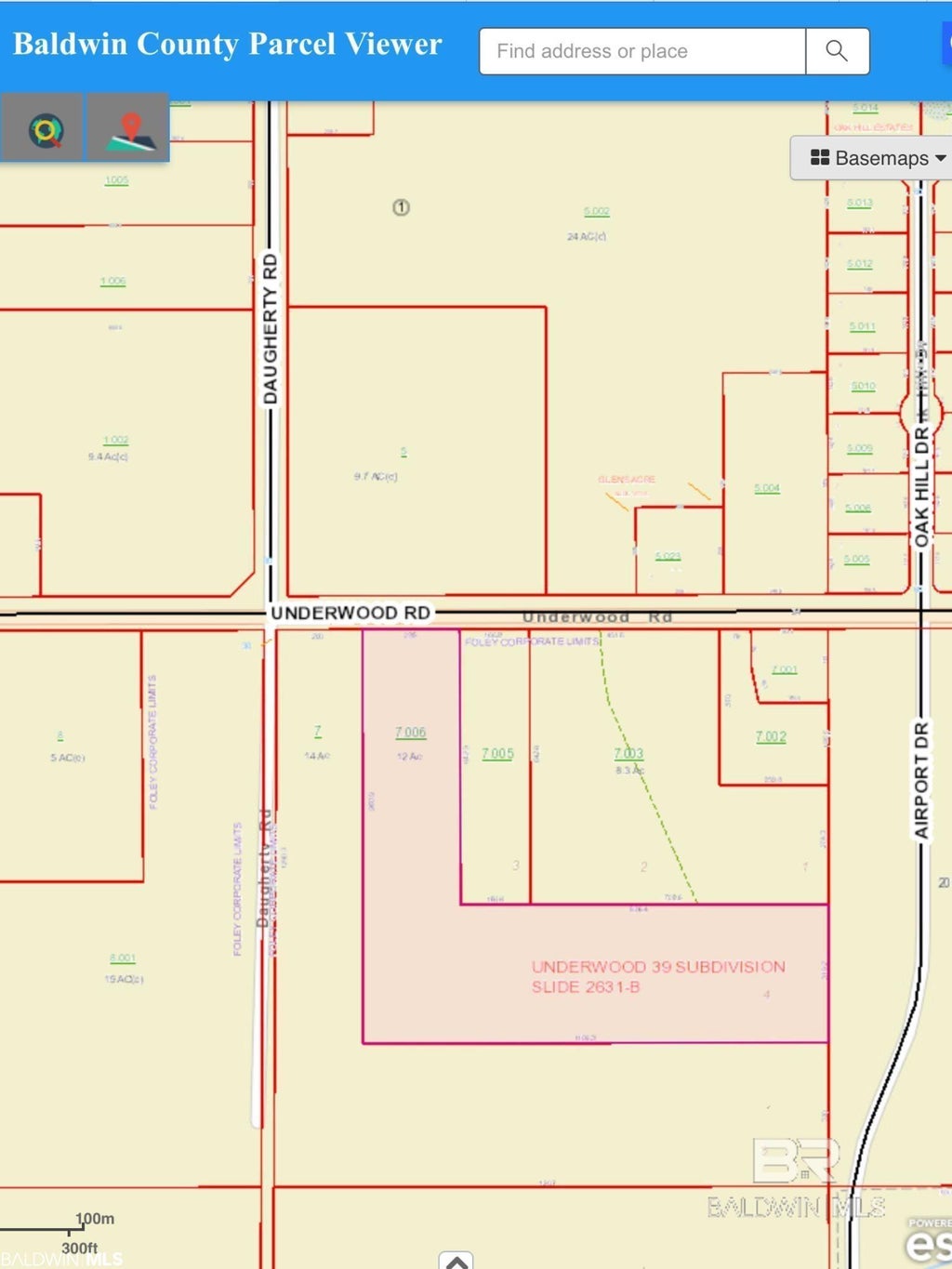

8. Can I use a 1031 exchange on raw land?

Absolutely. Many investors buy and hold lots in areas like Gulf Breeze, Gulf Shores, or Alys Beach with the plan to build or resell later. Raw land can be exchanged into another parcel, or into income-producing real estate like a condo or commercial property.

9. What if I want to eventually live in my replacement property?

This is a common strategy. You must first hold the replacement property as an investment for a period of time (typically advised at least two years). Later, you may be able to convert it to a primary residence. Timing and intent matter, so always work with a tax advisor to structure this properly.

Why the Gulf Coast is Ideal for 1031 Exchanges

The Gulf Coast is full of diverse opportunities:

-

Orange Beach & Gulf Shores – Strong rental demand and boating access.

-

Perdido Key & Pensacola – Quieter, with growing appreciation.

-

Destin & 30A – High-end luxury markets with strong vacation rental appeal.

-

Santa Rosa Beach & Alys Beach – Exclusive communities with long-term growth potential.

-

Gulf Breeze – A popular residential and investment hub near Pensacola, attractive for both short- and long-term rentals.

This variety makes our area especially appealing for investors looking to upgrade, diversify, or expand their portfolios through 1031 exchanges.

Final Thoughts

1031 exchanges can be a powerful way to grow wealth on the Gulf Coast, but they are also complex. I always recommend that my buyers and sellers consult with a qualified tax attorney or CPA before moving forward. My role as a real estate advisor is to help identify the right properties, guide you through the timing, and make sure your investment goals align with the exchange rules.

If you’re curious about using a 1031 exchange in Gulf Breeze, Orange Beach, Gulf Shores, Perdido Key, Pensacola, Destin, Santa Rosa Beach, or Alys Beach, I’d love to share what I’ve learned from years of experience helping investors just like you.

When it comes to finding the home of your dreams in a fast-paced market, knowing about new listings as soon as they are available is part of our competitive advantage.Sign up to see new listings in an area or specific community. Contact Meredith with any questions you may have.

#searchthegulf #meredithamon #becausewelivehere

Search Coastal Alabama Homes and Real Estate For Sale

.gif)

How to Build Equity with New Construction on the Gulf Coast

How to Build Equity with New Construction on the Gulf Coast

Along the Gulf Coast, building a home isn’t just about creating a place to live—it’s about crafting equity from the ground up. I’ve spent years helping investors and homeowners turn land into legacy. In markets like Orange Beach and Ono…

30532 Ono North Loop West New Construction Home For Sale Ono Island

Ask A Question or Sign Up To See New Real Estate Listings Before Your Competition