THE ULTIMATE INVESTOR’S GUIDE TO GULF COAST REAL ESTATE

By Meredith Amon, Licensed in Alabama and Florida

Guided by Integrity. Backed by Experience. Search the Gulf with Meredith Amon

When it comes to real estate investing along the Gulf Coast, there’s no one-size-fits-all answer. Whether you’re purchasing with reinvested capital, exploring a 1031 exchange, or entering the market for the first time, success depends on a few key questions:

-

How do you plan to use the property?

-

How long do you intend to hold it?

-

What type of return are you seeking—monthly income, long-term appreciation, or both?

As a full-time real estate advisor and Gulf Coast resident, I help investors answer these questions and match them with properties that align with both their personal goals and financial objectives.

Single-Family Homes: Flexibility, Appreciation & Resale Strength

Single-family homes are often the most versatile option for investors. These properties work well for long-term rentals, vacation homes, or resale strategies—and they tend to outperform condos in terms of appreciation and buyer demand over time.

Advantages:

-

Historically stronger long-term appreciation

-

Lower or no HOA dues

-

Greater control over property management and use

-

Flexibility to transition from rental to resale or primary use

-

More appealing to future buyers, including full-time residents

One reason single-family homes remain so desirable is the broader market they serve. In fast-growing areas like Baldwin County, where Orange Beach and Gulf Shores are located, homes are sought after not only by vacationers but also by year-round residents. With some of the top-rated public schools in Alabama, these communities offer an added layer of demand that strengthens resale value and helps maintain steady property appreciation.

Condos: Income-Producing and Low-Maintenance

Condos remain a solid option for those looking to maximize short-term rental income while enjoying a low-maintenance setup. Many buyers use their condo for personal vacations while renting it out during peak season, especially in Gulf-front or amenity-rich developments.

Advantages:

-

Turnkey living with professional property and rental management

-

Strong seasonal demand for vacation rentals

-

Lower price point compared to Gulf-front homes

-

Ideal for part-time personal use plus rental income

Considerations:

-

HOA fees can be high and eat into cash flow

-

Some buildings limit financing options or rental terms

-

Appreciation may be steadier but slower compared to single-family homes

-

Property performance is often tied to the building’s overall condition and management

Condos can absolutely perform well as investments, especially when matched with the right strategy and timeline. If you're looking for convenience, location, and dependable income, this may be your path.

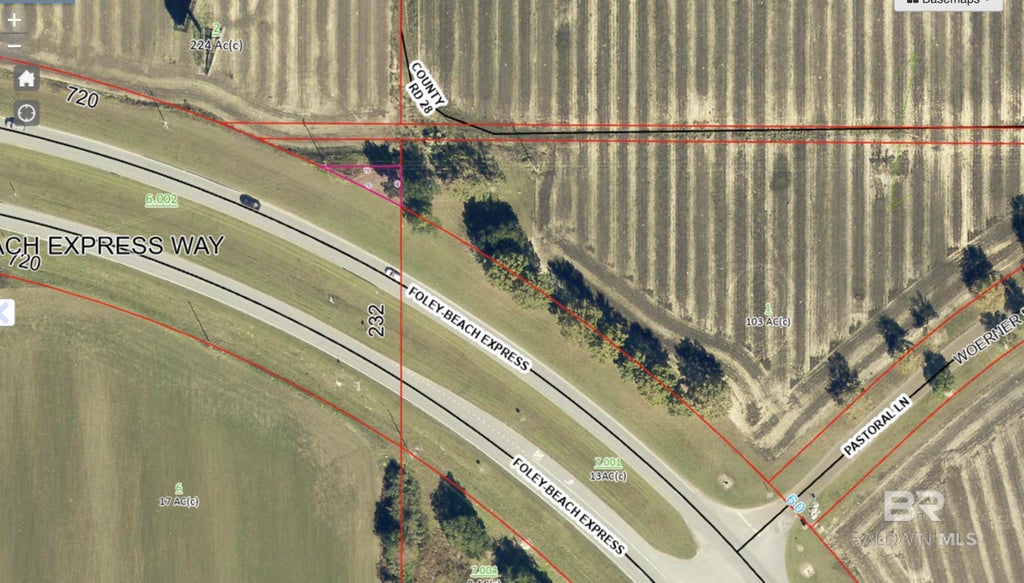

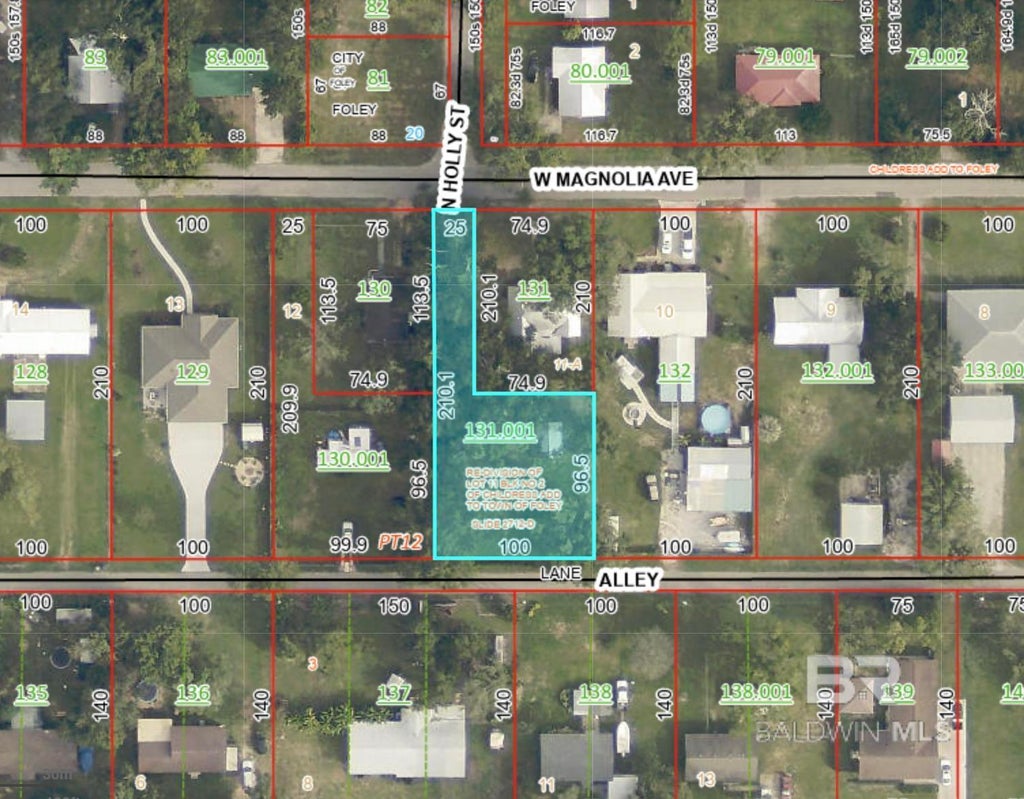

Land + New Construction: Build Equity from the Ground Up

One of the most powerful strategies for long-term ROI on the Gulf Coast is buying land and building new construction. This approach offers flexibility, tax benefits, and instant equity creation—especially when working with a team like mine, where plans are already prepared, finishes are pre-selected, and the process is streamlined.

Here’s why this model makes sense:

-

Build equity during construction

-

Customize the layout and materials to suit rental or resale goals

-

Leverage today’s construction standards for energy efficiency and insurance savings

-

Take advantage of appreciation while your home is being built

-

Flexibility to rent the property, sell it immediately, or hold for long-term gains

This approach is ideal for investors who want to maximize value at every phase—from land acquisition to resale or rental income. And when you work with a seasoned local team that already has the process dialed in, you avoid many of the delays and pitfalls that can derail a project.

Timeline Matters: Match Strategy with Hold Period

No matter which path you choose, the length of time you hold the property will influence everything from tax benefits to appreciation and income.

-

Short-Term Hold (3–5 years): Prioritize high-demand locations and flexible use properties.

-

Long-Term Hold (5–10+ years): Focus on single-family homes or new builds in growth corridors for the strongest appreciation.

-

Hybrid Approach: Build, rent for a few years, then sell during peak market cycles.

I help investors align their timeline with the right property strategy—and connect them with trusted professionals, from builders and surveyors to property managers and lenders.

Florida vs. Alabama: Know the Numbers

With licenses in both states, I guide investors through key differences between the Florida and Alabama coasts:

| Category | Alabama | Florida |

|---|---|---|

| Property Taxes | Lower (avg. 0.41%) | Higher (avg. 0.89%) |

| Insurance Premiums | Lower, especially for Gold Fortified new builds | Higher—especially in flood-prone areas |

| HOA Costs | Often minimal with single-family homes | High in most resort-style condo complexes |

| Rental Flexibility | High in Orange Beach and Gulf Shores | High opportunity based on city and county |

| Resale Trends | Steady growth in Baldwin County | Strong demand but more competition |

Final Thoughts

Whether you’re purchasing a condo, single-family home, or building from the ground up, the most successful investments are the ones that align with your goals, timeline, and long-term strategy.

Remember—real wealth in real estate comes not just from monthly P&L, but from smart acquisition, strategic use, appreciation, tax benefits, and resale timing.

I’d love to help you explore what’s possible and guide you toward the best opportunities—whether that’s identifying land to build on, selecting the right neighborhood, or connecting you with a trusted builder and design team.

Let’s connect and start planning your next move on the Gulf Coast.

#searchthegulf #meredithamon #becausewelivehere

Search Coastal Alabama Homes and Real Estate For Sale

- All Listings

.gif)

Aragon Park Homes: Timeless Southern Architecture in the Heart of Downtown Pensacola

Aragon Park Homes: Timeless Southern Architecture in the Heart of Downtown Pensacola

There’s something special about Aragon Park in downtown Pensacola — a neighborhood where modern craftsmanship meets the timeless soul of the South. Just steps from Seville Square, Palafox Street, Gallery Night, Hub…

Valhalla V-37: The Orange Beach Boater’s Dream

Stem Wall vs. Monolithic Slab Foundations on the Gulf Coast

Ask A Question or Sign Up To See New Real Estate Listings Before Your Competition

When it comes to finding the home of your dreams in a fast-paced market, knowing about new listings as soon as they are available is part of our competitive advantage.Sign up to see new listings in an area or specific community. Contact Meredith with any questions you may have.