Understanding Real Estate Closing Costs: What Buyers and Sellers Need to Know

As a Gulf Coast real estate advisor, I often encounter questions about closing costs and how they are divided in a real estate transaction. A common misconception is that when a contract states the buyer and seller will "split the closing costs," it means all costs are combined and divided equally. That’s not the case. Instead, each party is responsible for their own respective closing costs, and those costs are very different for buyers and sellers. Let’s break it down in simple terms.

What Are Closing Costs?

Closing costs are the fees and expenses associated with finalizing a real estate transaction. These costs vary depending on whether you’re the buyer or the seller and can include everything from title work to loan origination fees.

Buyer’s Closing Costs

For buyers, closing costs are generally higher when financing a property. A good rule of thumb in Alabama is to expect closing costs to be approximately 3% of the purchase price when obtaining a loan. However, these costs can vary based on factors like property taxes, insurance, and lender requirements.

Here’s what a buyer’s closing costs typically include:

- Loan Origination Fee: This is charged by the lender to process your loan application.

- Appraisal Fee: Paid to determine the market value of the property.

- Credit Report Fee: Covers the cost of pulling your credit report for the loan.

Understanding Real Estate Closing Costs: What Buyers and Sellers Need to Know

As a Gulf Coast real estate advisor, I often encounter questions about closing costs and how they are divided in a real estate transaction. A common misconception is that when a contract states the buyer and seller will "split the closing costs," it means all costs are combined and divided equally. That’s not the case. Instead, each party is responsible for their own respective closing costs, and those costs are very different for buyers and sellers. Let’s break it down in simple terms.

What Are Closing Costs?

Closing costs are the fees and expenses associated with finalizing a real estate transaction. These costs vary depending on whether you’re the buyer or the seller and can include everything from title work to loan origination fees.

Buyer’s Closing Costs

For buyers, closing costs are generally higher when financing a property. A good rule of thumb in Alabama is to expect closing costs to be approximately 3% of the purchase price when obtaining a loan. However, these costs can vary based on factors like property taxes, insurance, and lender requirements.

Here’s what a buyer’s closing costs typically include:

- Loan Origination Fee: This is charged by the lender to process your loan application. Typically 1%

- Appraisal Fee: Paid to determine the market value of the property. Approximately $500

- Credit Report Fee: Covers the cost of pulling your credit report for the loan. Approximately $50

- Title Insurance (Owner’s and Lender’s Policies): Protects the buyer and lender against potential title defects. Approximately $500

- Recording Fees: Paid to record the deed with the county. Approxiamtely $150-$200

- Prepaid Items: These include property taxes, homeowner’s insurance, and sometimes mortgage insurance if required. Approximately $5,000

- Escrow Fees: Charged by the title company or attorney for managing the closing process. Approximately $200-$300

For a $400,000 property, a buyer financing the home might expect closing costs around $12,000 (3% of the purchase price), though this number can go up or down depending on insurance premiums and tax requirements.

Seller’s Closing Costs

For sellers, closing costs are typically lower and are primarily related to transferring ownership of the property. These might include:

- Title Work: Ensuring the title is clear and ready to transfer.

- Owner’s Title Insurance Policy: Protects the buyer’s interest in the property.

- Deed Preparation: Drafting the legal documents to transfer ownership.

- Prorated Property Taxes: Sellers pay their share of property taxes up to the closing date.

- Home Warranty (if negotiated): If the seller agreed to provide a home warranty as part of the contract.

For a $400,000 property, typical seller closing costs might range from $2,000 to $3,500 depending on local requirements and negotiated terms.

What About Real Estate Professional Service Fees?

Real estate service fees are a cost that can vary based on the agreements. These professional service fees are paid to the real estate professionals involved in the transaction.

Personal Tip

I always tell my clients to budget for closing costs early in the process. Buyers should request a loan estimate from their lender, which outlines their expected fees. Sellers can request a net sheet from me to understand what they’ll walk away with after closing costs. As one of my clients once said, “It’s better to know upfront than to be surprised at the table.”

If you’re unsure about your closing costs or want a clear estimate, I’d be happy to guide you through the process. Remember, every transaction is unique, and understanding these fees is key to making a smooth transition into your next chapter.

#searchthegulf #meredithamon #becausewelivehere

Search Coastal Alabama Homes and Real Estate For Sale

- All Listings

.gif)

Red October: Tales of the Gulf Coast’s Fall Fishing Season

RED OCTOBER: TALES OF THE GULF COAST’S FALL FISHING SEASON

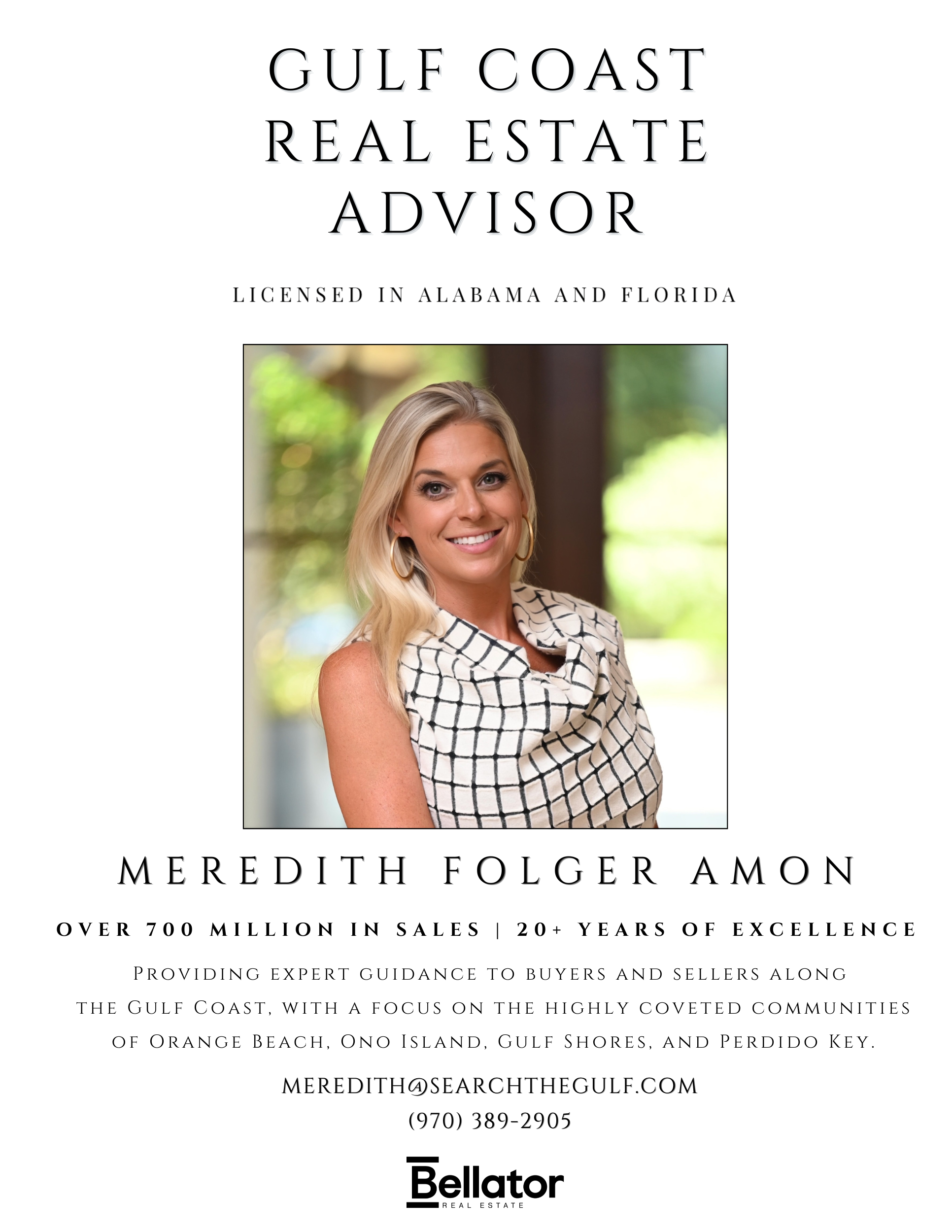

By Meredith Folger Amon — Licensed in Alabama and Florida

Guided by Integrity. Backed by Experience. Search the Gulf with Meredith Folger Amon.

Come October, the Gulf turns a shade of silver-blue that’s hard to describe and impossible to…

Latitudes and Attitudes: October Fishing on the Gulf

Ask A Question or Sign Up To See New Real Estate Listings Before Your Competition

When it comes to finding the home of your dreams in a fast-paced market, knowing about new listings as soon as they are available is part of our competitive advantage.Sign up to see new listings in an area or specific community. Contact Meredith with any questions you may have.

Leave A Comment