Understanding 1031 Tax Deferred Exchanges on the Alabama Gulf Coast

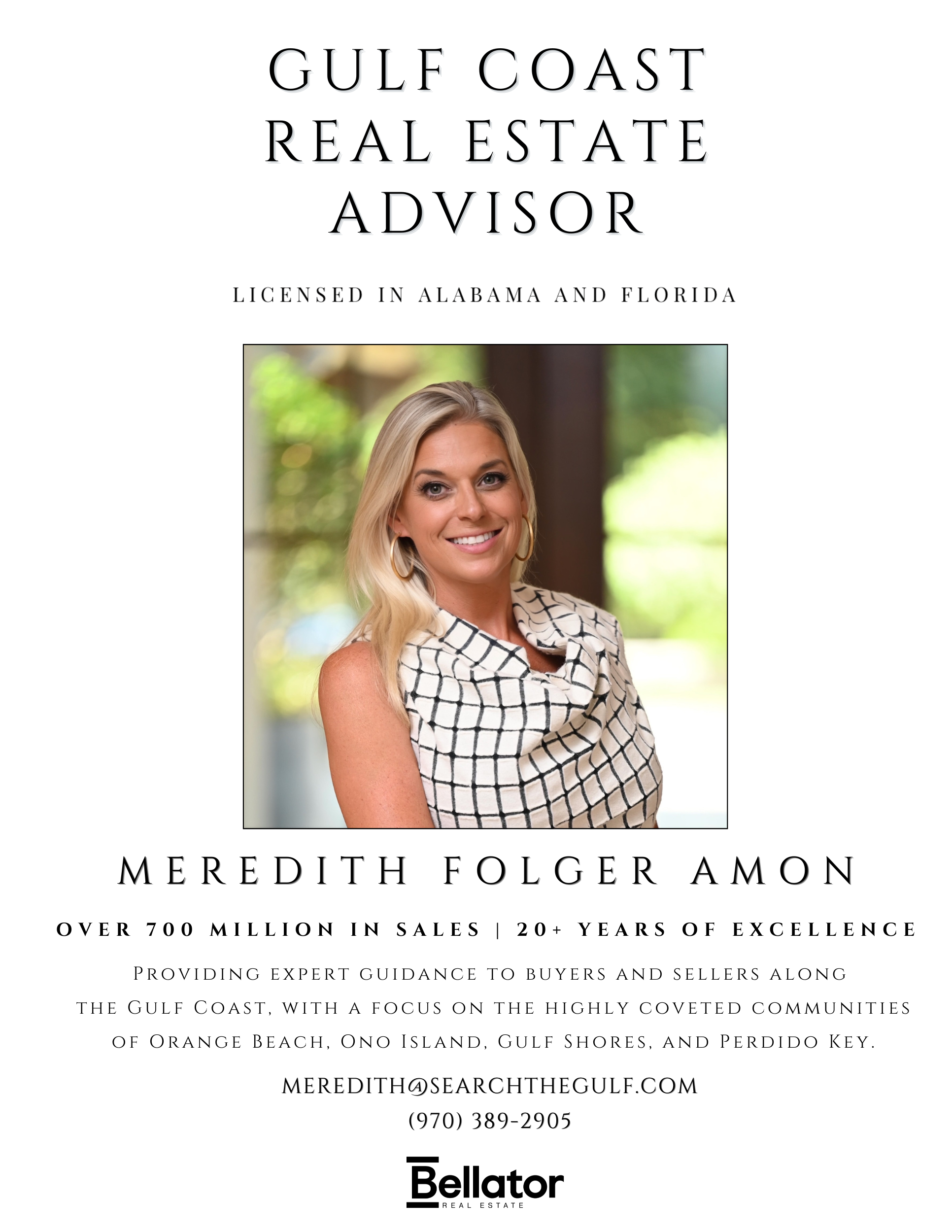

By Meredith Folger Amon, Licensed in Alabama and Florida

Guided by Integrity. Backed by Experience. Search the Gulf with Meredith Folger Amon

Disclaimer

I am not a tax attorney, nor do I provide tax or legal advice. This article is for informational purposes only. Please consult with a qualified tax attorney or CPA regarding your individual situation. Neither I, Meredith Folger Amon, nor Bellator Real Estate LLC, are responsible for decisions made based on the information provided here.

What is a 1031 Exchange?

A 1031 tax deferred exchange, named after Section 1031 of the Internal Revenue Code, allows real estate investors to defer capital gains taxes when they sell one investment property and purchase another “like-kind” property. Instead of paying taxes immediately on the sale, the funds are rolled into the next investment, which can help investors grow their real estate portfolios more efficiently.

For those investing in Gulf Shores, Orange Beach, Ono Island, or Perdido Key, a 1031 exchange can be an excellent way to move from one property to another without sacrificing equity to taxes.

How a 1031 Exchange Works

-

Like-Kind Properties: You must exchange one investment property for another of similar use (not necessarily the same type).

-

Timeline: After selling your property, you have 45 days to identify potential replacement properties and 180 days to close on one of them.

-

Equal or Greater Value: The new property must be of equal or greater value to fully defer taxes.

-

Qualified Intermediary: A third party must hold the proceeds between the sale and purchase—you cannot take possession of the funds directly.

Why Use a Local Expert?

The Gulf Coast real estate market has unique opportunities and challenges, from waterfront properties with boating amenities to new construction and condo investments. Working with a local legal expert ensures you not only meet IRS requirements but also take advantage of the best options in our market.

One of the most respected names in 1031 exchanges and real estate law on the Alabama Gulf Coast is Timothy D. Garner of Garner Law and Attorneys Title, Inc. in Gulf Shores.

About Timothy D. Garner & Attorneys Title, Inc.

Timothy D. Garner is a partner at Olmstead, Harrell & Garner, LLC, and President of Attorneys Title, Inc. in Gulf Shores, Alabama. With more than three decades of experience in real estate law, Tim specializes in:

-

IRS Section 1031 tax deferred exchanges

-

Commercial and residential real estate development

-

Loan closings and title insurance matters

-

Condominium and subdivision associations

-

Foreclosures, curative litigation, and lender representation

Since 2001, Attorneys Title, Inc. has been a trusted full-service title insurance and escrow closing company, Best Practices certified, and proudly serving Baldwin County. All title research and closings are directly performed or supervised by licensed attorneys, with all transactions underwritten by Old Republic National Title Insurance Company.

Closing Manager Gail W. Cash brings over 20 years of closing experience as a paralegal, ensuring clients receive the highest level of professionalism and care.

Contact Information

For questions about 1031 exchanges or assistance with your Gulf Coast contact:

Attorneys Title, Inc./ Tim Garner

117 West 14th Ave

Gulf Shores, Alabama 36542

251-968-5540

https://attorneystitleinc.com/

| Feature | Alabama | Florida |

|---|---|---|

| State Income Tax | 2%–5% (progressive rates; applies to capital gains) | No state income tax (capital gains not taxed at state level) |

| Property Taxes | Average effective property tax rate ~0.40% | Average effective property tax rate ~0.80% |

| Homestead Exemption | Reduces assessed value of primary residence by $4,000 (state) and $2,000 (county); does not apply to investment properties | Up to $50,000 exemption for primary residence; does not apply to investment properties |

| Transfer Taxes | Alabama levies a recording tax ($0.50 per $500 of value) | Florida documentary stamp tax on deeds (0.70% in most counties); mortgage doc stamp and intangible tax may also apply |

| 1031 Exchange Rules | Recognized by Alabama law; state taxes deferred if IRS rules followed | Recognized by Florida law; no state capital gains tax, so only federal deferral applies |

| Timeline | 45 days to identify replacement property; 180 days to close | Same federal IRS rules apply (45 days to identify, 180 days to close) |

| Qualified Intermediary Required? | Yes | Yes |

| Local Market Focus | Gulf Shores, Orange Beach, Ono Island, Baldwin County | Destin, 30A, Santa Rosa Beach, Pensacola, Gulf Breeze, Alys Beach |

Frequently Asked Questions About 1031 Exchanges on the Gulf Coast

What is the purpose of a 1031 exchange?

A 1031 exchange allows me to sell an investment property and reinvest the proceeds into another property of equal or greater value without paying capital gains taxes right away. This lets me keep more of my money working for me and helps grow my portfolio along the Gulf Coast.

Can I use a 1031 exchange between Alabama and Florida?

Yes. I can sell an investment property in Alabama and buy a replacement property in Florida (or vice versa). The IRS allows cross-state exchanges as long as the properties are both within the United States and qualify as “like-kind” investments.

How long do I have to identify and close on a new property?

I have 45 days from the sale of my property to identify potential replacement properties and 180 days total to close on the new property. It’s critical to work with a qualified intermediary and legal team during this time frame to stay compliant.

Do primary residences qualify for a 1031 exchange?

No. A 1031 exchange is only available for investment or business properties. However, there are other tax strategies for primary residences that may be more appropriate.

Can I roll two properties into one through a 1031 exchange?

Yes, it’s possible to consolidate multiple investment properties into one larger purchase. The key requirement is that the new property must be of equal or greater value than the total of the properties sold.

Who should I contact for help with a 1031 exchange in Gulf Shores, Alabama?

I recommend contacting Timothy D. Garner of Attorneys Title, Inc. in Gulf Shores, Alabama. Tim and his team specialize in real estate law, closings, and 1031 exchanges.

Contact Information

Attorneys Title, Inc.

117 West 14th Ave

Gulf Shores, Alabama 36542

251-968-5540

https://attorneystitleinc.com/

Key Insights for Investors

-

Alabama: You can defer both federal and state capital gains taxes with a 1031 exchange, but remember Alabama does tax capital gains when they are eventually recognized. Lower property taxes are an advantage for long-term holding.

-

Florida: The biggest draw is no state income tax, which means no state capital gains tax. However, property taxes and transfer costs can be higher. This makes Florida appealing for long-term investors and those considering relocation.

-

Strategy Tip: Many investors sell in Alabama and roll into higher-value properties in Florida (or vice versa) to maximize portfolio growth. Working with an experienced advisor like Tim Garner at Attorneys Title, Inc. in Gulf Shores ensures compliance and smooth transactions across state lines.

Final Thoughts

A 1031 exchange can be one of the smartest ways to build wealth through real estate, especially in high-demand markets like the Gulf Coast. If you are considering selling one investment property and purchasing another in Gulf Shores, Orange Beach, Ono Island, or surrounding areas, I recommend speaking with Tim Garner and his team at Attorneys Title, Inc. for trusted guidance through the process.

As a Gulf Coast Real Estate Advisor, I can help you identify the right properties while you rely on a trusted local law firm to manage the legal and tax-deferred side of the transaction. Together, we can help you make the most of your investment strategy.

#searchthegulf #meredithfolger #becausewelivehere

Search Coastal Alabama Homes and Real Estate For Sale, $800,000 - $900,000

.gif)

Mirella Street on Bayou Garcon | Exclusive Waterfront Land for Sale in Pensacola, Florida

Mirella Street on Bayou Garcon: A Waterfront Legacy in the Making

There’s something quietly reverent about a piece of land that still feels untouched — where the water meets the marsh in a slow, steady rhythm, and the only sound you hear is the rustle of the bay breeze through the pines. Along Mirella…

Luxury Living in Gulf Breeze & Navarre, Florida | Southern Coastal Homes

Homes and Waterfront Properties on Old River, Ono Island

Ask A Question or Sign Up To See New Real Estate Listings Before Your Competition

When it comes to finding the home of your dreams in a fast-paced market, knowing about new listings as soon as they are available is part of our competitive advantage.Sign up to see new listings in an area or specific community. Contact Meredith with any questions you may have.

Would you like me to also create an SEO-optimized FAQ section with schema markup on 1031 exchanges for your site? That could help this article rank higher locally.

Posted by Meredith Folger Amon on

Leave A Comment